Boat loan calculator with down payment

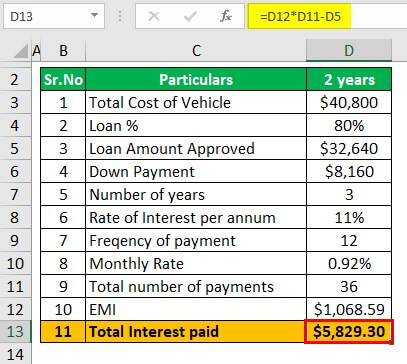

Use our boat loan calculator to estimate your monthly interest rate and then apply for your boat loan today. This auto loan calculator has everything that you may need to calculate your payment with options for down payment trade in sales tax fees extra payments bi-weekly payments and a detailed auto amortization.

Boat Loan Calculator Step By Step Guide With Examples

Apply Online Now Get Rate Quote.

. Rates used for calculations are not considered rate guarantees or offers. Bankrates mortgage calculator gives you a monthly payment estimate after you input the home price your down payment the interest rate and length of the loan term. To help you see current market conditions and find a local lender current current Redmond boat loan rates and personal loan rates personal loan rates are published below the calculator.

Think of it as the fee you are. Use the BoatUS boat loan calculator to calculate your boat loan by monthly boat loan payments or total boat loan. Standard down payment is 15 but depending on your boat age loan amount and loan term the required down payment can be between 10 - 30.

However keep in mind that a bad credit boat loan will likely require a minimum down payment and charge a higher interest rate. Down Payment This figure represents the amount a purchaser is going to pay at the time of purchase. The principal is the amount of the loan that you are taking out and will usually be the cost of the boat minus any down payment you make.

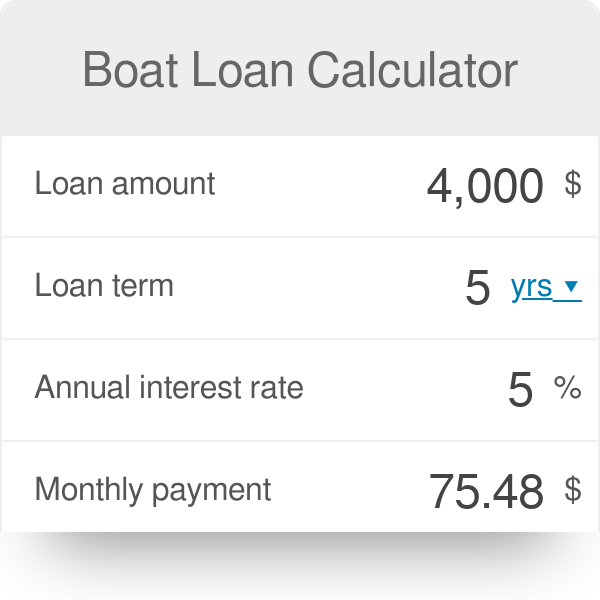

The LendingTree boat loan calculator helps you determine your monthly payment using the loan amount interest rate and loan term. Downpay Trade-in less owed on Trade-in. Personal loans are very flexible.

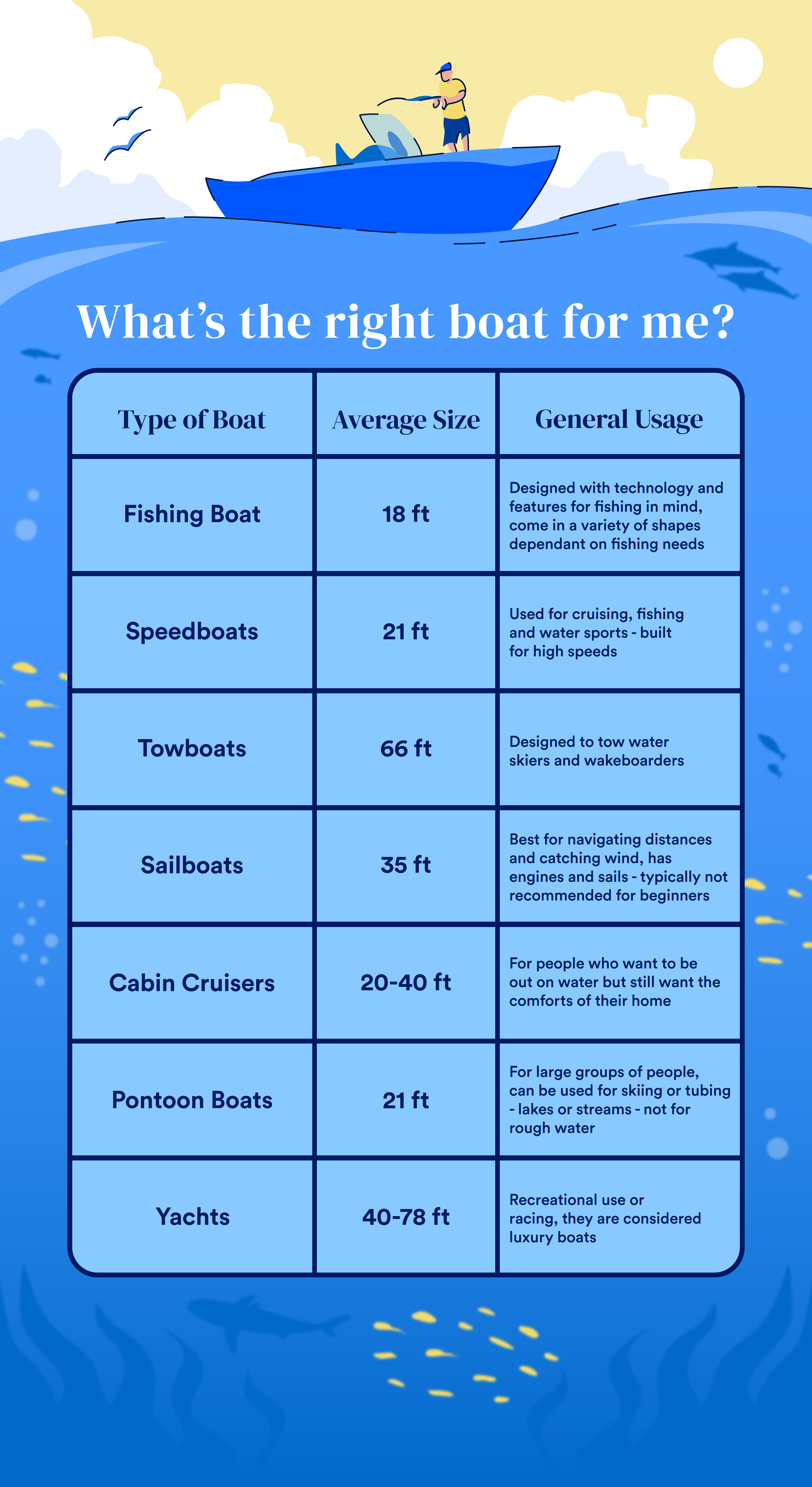

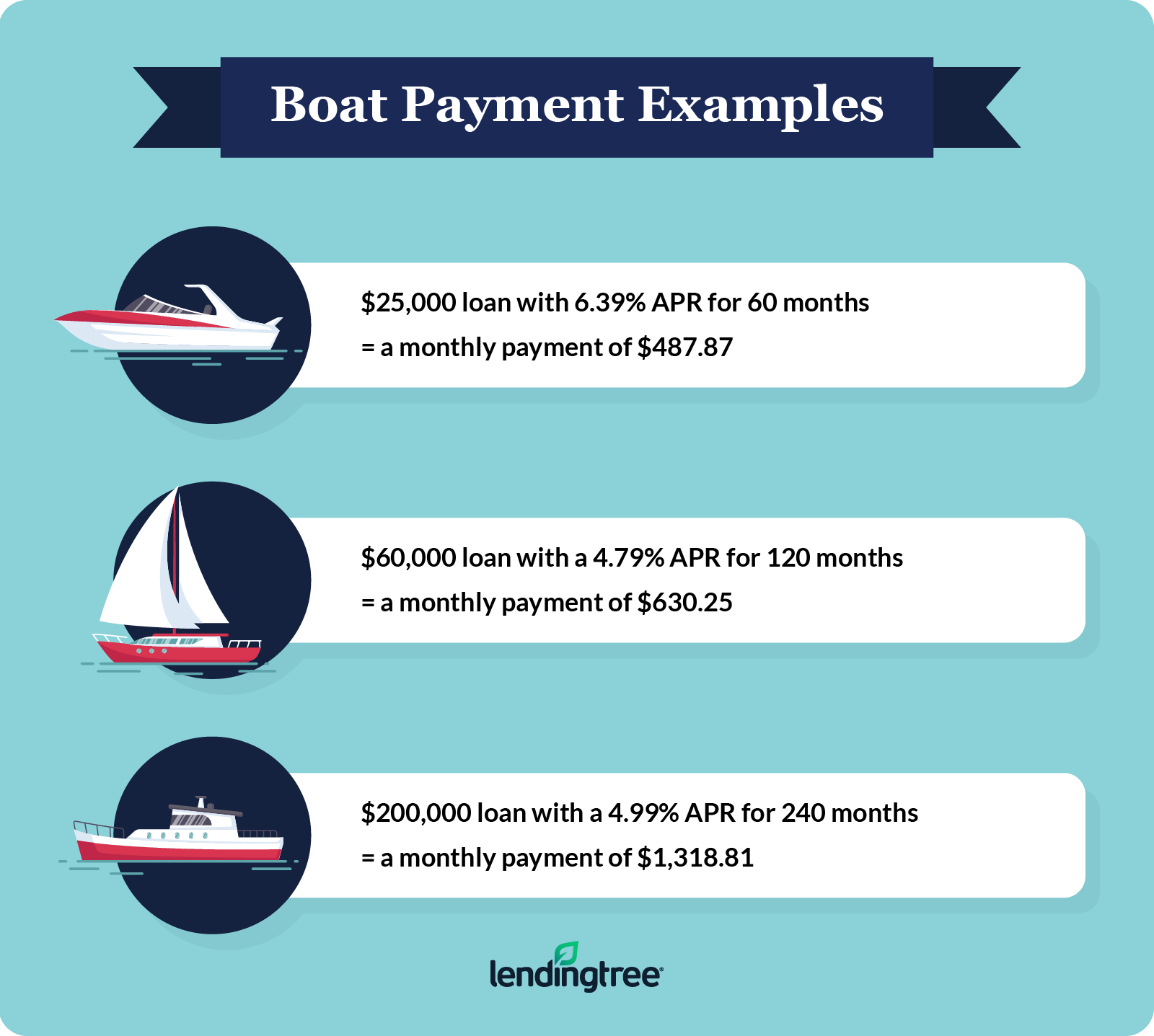

Simply enter in your desired monthly payment or vehicle price and it will return your results. Whether you are buying an used car or finance for a new car you will find this auto loan amortization calculator come in handy. A boat loan can help you finance the cost of a boat which typically ranges between 20000 to 75000 depending on the type of boat.

An ATV loan calculator that allows one to enter data for a new or existing ATV loan to determine ones payment. The second monthly payment budget calculator shows how expensive of a boat you can buy given a monthly loan. You can always pay your auto.

If the down payment is less than 20 mortgage insurance may be required which. With a lower credit score you should expect a larger down payment or a higher boat loan interest rate. Interest Rate This is the rate at which you will have to pay back additional funds for the use of money lent to you.

Higher loan amounts often equate to longer boat loan terms. Its important to keep in mind with a longer loan term although your monthly payments might be lower the total amount of interest you pay over the life of the boat loan will increase. Paying for home improvements or a major life event like a move.

Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and a 025 direct deposit discount. You can mail your car loan payment to. Keep in mind that a down payment is typically 15 to 20 and.

Generally borrowers with lower credit scores will be required to put down a larger down. It also depends on the loan amount and the loan term. Use this FHA mortgage calculator to get an estimate.

Fill out a Free Online Application today. Some lenders will offer loans to borrowers with less-than-stellar credit. Interest Rates are calculated based off of borrowers credit scores and the amount of money being lent.

On average boat loan lengths range from 10-15 years. Apply for your boat loan today. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare.

Common reasons to apply for a personal loan include consolidating multiple debts into one. Then there is the extra monthly payment field which lets you see how quickly one could pay down their ATV loan with an extra. Rebate added to down.

Bank of America NA PO Box 15220 Wilmington DE 19886-5220. The higher the down payment amount the lower the. Experian 2020 Q1 data published on August 16 2020 Across the industry on average automotive dealers make more money selling loans at inflated rates than they make from selling cars.

The interest rate is how the lender earns a profit on your loan. The amount of the down payment on an RV loan varies. Enter your desired monthly payment amount to find a list of boats at your customized price.

It depends on the borrowers credit score income and overall financial profile. This car payment calculator takes all the hard work out of making a sound financial decision. Be sure to include your loan account number along with your payment.

Everyone knows that boats can be expensive and thus usually require financing. Its usually anywhere from 10 percent to more than 30 percent. FHA loans have lower credit and down payment requirements for qualified homebuyers.

Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments helps you figure out how expensive of a car you can afford to buy given a set monthly budget. About Us Affiliates Contact. Excel Credit 800 337-7774 505 Wekiva Springs Rd.

This boat loan calculator can help. To minimize the amount of interest paid increase the amount of your down payment and increase your monthly payments when possible. Additionally the calculator breaks down monthly payments by year helping you plan ahead.

Not sure what boat you can afford. Deposit This is the total amount you have. This calculator figures monthly boat loan payments.

Estimated monthly payment and APR calculation are based on down payment of 20 and borrower-paid finance charges of 0862 of the base loan amount. Although a credit score in the high 600s or 700s is ideal you may still be eligible for a boat loan with a lower credit score. Use the calculator to price.

You can get a boat loan with a 700 credit score but most lenders prefer credit scores of 700 or higher. SoFi rate ranges are current as of 82222 and are subject to. One can enter an extra payment and a rate of depreciation as well to see how an ATVs value may decrease.

Interest is accrued daily and charged as per the payment frequency. Take the guesswork out of boat shopping with this easy-to-use boat payment calculator. Get a fixed-rate loan with a term up to 15 years¹ 180 months with Mountain America Credit Union.

For instance the minimum required down payment for an FHA loan is only 35 of the purchase price. If you find that the estimated boat loan payment could make your monthly finances a bit tight consider adjusting the loan amount andor boat loan term. Your lender may.

We offer flexible financing terms and some of the best boat loan rates. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. Calculations assume that the interest rate will remain constant over the entire amortizationrepayment period but actual interest rates may vary over the amortization period.

RV Loans RV Loan Payment Calculator. Use our boat loan calculator to calculate your monthly payment based on loan amount and boat loan term length. Just enter values below such as down payment trade-in value and boat price to quickly find out your new monthly payment.

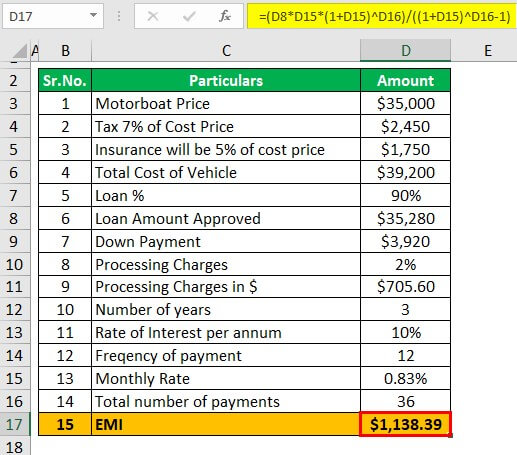

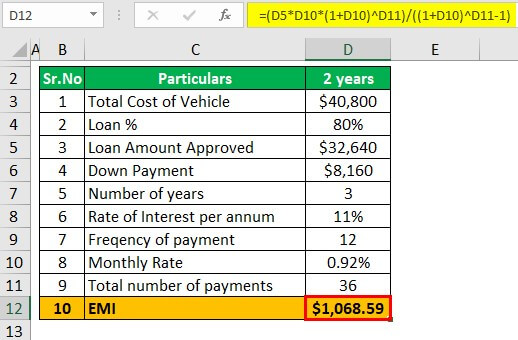

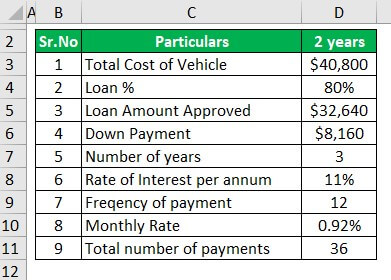

Boat Loan Calculator Step By Step Guide With Examples

How To Get A Used Boat Loan Bankrate

Boat Loan Calculator Estimate Monthly Payments On Your New Or Used Boat

How Long To Finance A Boat My Financing Usa

Boat Loan Calculator Boat Loan Payment Calculator

New Used Boat Financing Calculator Monthly Boat Loan Repayments

9 Bad Credit Boat Loans 2022 Badcredit Org

Cost Of Owning A Boat Bankrate

Boat Loan Calculator Boat Loan Payment Calculator

Boat Loans Uccu

New Used Boat Financing Calculator Monthly Boat Loan Repayments

Boat Loan Calculator Step By Step Guide With Examples

Boat Loan Calculator Step By Step Guide With Examples

Boat Loan Calculator

Boat Financing How To Finance A Boat Lendingtree

Boat Loans How Boat Financing Works Credit Karma

New Used Boat Financing Calculator Monthly Boat Loan Repayments